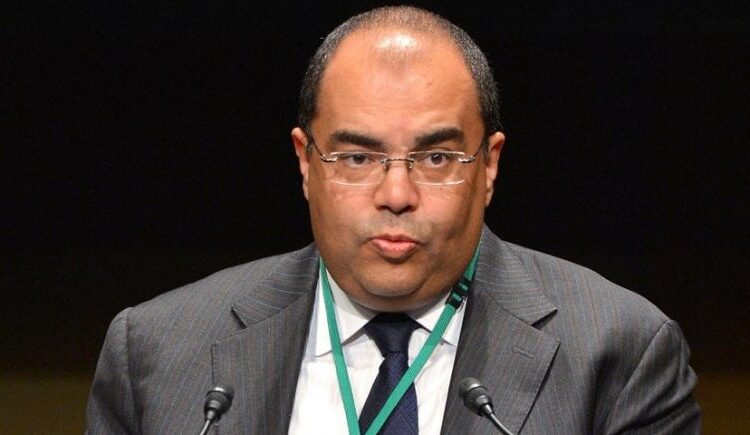

Dr Mahmoud Mohieldin, UN Climate Change High Level Champion for Egypt and UN Special Envoy on Financing 2030 Sustainable Development Agenda, said that accelerating and activating the financing of sustainable development goals requires the availability of accurate and updated data and the integration of public and private, internal and external sources of financing.

This came during his participation in a session entitled “Planning and Financing Sustainable Development in the Stages of Crisis and Recovery” within the activities of the Arab Forum for Sustainable Development hosted by ESCWA headquarters in the Lebanese capital Beirut, with the participation of Saeed Mohammed Al Saqri, Omani Minister of Economy, and Ahmed Kamali, Deputy Minister of Planning and Economic Development in Egypt, Hiba Ahmed, Director General of the Islamic Solidarity Fund for Development, and a number of Arab and international officials.

Mohieldin said that the availability of financing and technological solutions is essential for the implementation of development action, beside the political will of governments and institutions, as the real political will would better manage development action, make the most of technological solutions and direct financing to the more deserving areas of development action.

In this regard, Mohieldin praised the Sustainable Development Financing Report in Egypt as the first report of its kind in the Arab region and aims to analyze the sources of development financing and the motivating factors to drive development action, stressing the importance of this type of report in the governments’ planning of development action and achieving their sustainable development goals.

Mohieldin pointed out the importance of developing general frameworks for financing development action, determining the cost of achieving the combined and not fragmented sustainable development goals, then setting development priorities and financing areas, which leads to knowing the size of the financing gap and then finding the best ways to bridge it, whether through blended financing or activating innovative financing tools.

He stated that debt swaps are one of the important elements of blended financing, as this mechanism contributes to transforming the public debts of countries into investments in various areas of sustainable development, which allows greater participation of private sector in financing and implementing development action, highlighting the need for governments to link public budgets to their sustainable development plans.

With regard to development finance solutions, Mohieldin stressed the importance of responding to the call of United Nations Secretary-General Antonio Guterres to bridge the sustainable development financing gap in general, estimated at $4 trillion annually, by overcoming the external debt crisis of countries, activating long-term financing policies while improving its conditions to include low interest rates, long-term grace and repayment periods, in addition to activating emergency funds to face different crises such as pandemics and damages caused by climate change.

Mohieldin confirmed the need to treat development action as one bloc and not to fragment it, explaining that this holistic approach was adopted by Egypt through its presidency of the climate conference in Sharm El Sheikh by integrating the goal of confronting climate change with other sustainable development goals, what is also adopted by the United Arab Emirates in preparing to host the next climate conference in Dubai, which is considered a conference of solutions in all aspects of climate action, and will witness the finish of the global evaluation process of what have been achieved so far of implementing Paris Agreement that will guide towards achieving climate goals in the coming years.

Discussion about this post