Recent data released by the Ministry of Finance and the Cabinet’s Information and Decision Support Centre (IDSC) has highlight*ed the tangible outcome of implementing Law No. 159 of 2023, which scrapped tax exemptions previously granted to state-owned entities.

The law offered a key step towards ensuring competitive neutrality and a fair business environment between the public and private sectors.

Addressing a press conference following the cabinet’s weekly meeting yesterday, Minister of Finance Ahmed Kouchouk affirmed that the implementation of the Competitive Neutrality Law has helped the ministry establish a culture of fair competition and building a “trust partnership with the private sector.”

Kouchouk affirmed the government’s commitment to building a competitive economy that enhances the private sector’s capabilities to lead growth and development.

According to the ministry, tax revenues increased by LE67.4 billion during the FY 2024/2025 as a direct result of eliminating tax privileges for government-affiliated entities.

A total of 134 state entities paid taxes on their income, contributing around LE13.3 billion in new revenues. Additionally, LE40.3 billion in income tax was collected from government bodies during 2023/2024 and 2024/2025, alongside LE 16.4 billion in taxes from tourism-related entities.

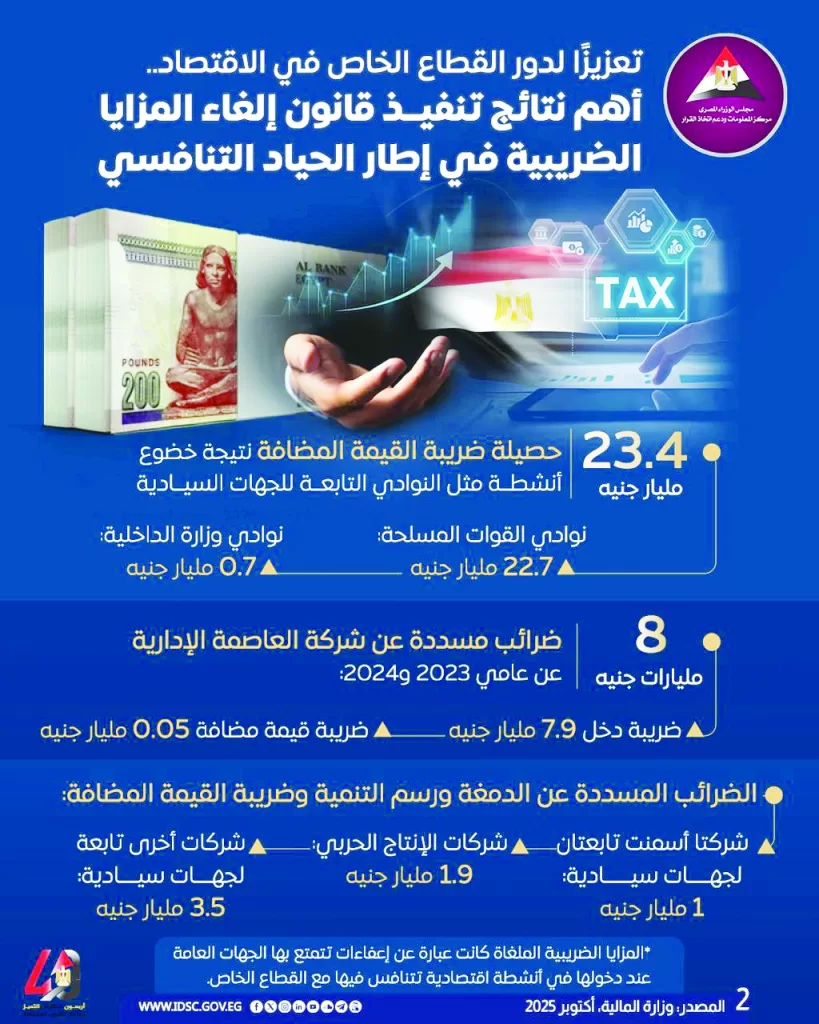

Among the most notable figures: LE23.4 billion in value-added tax (VAT) was collected from clubs and tourism bodies affiliated with sovereign institutions. This includes LE22.7 billion from clubs under the Armed Forces and LE0.7 billion from clubs of the Ministry of Interior.

Also, the Administrative Capital for Urban Development Company paid LE8 billion in taxes on profits for the 2023 and 2024 fiscal years – LE7.9 billion in income tax and LE0.05 billion in VAT.

Additional LE3.5 billion were collected from cement and development fees on VAT, including LE1.9 billion from military production companies and LE1 billion from other sovereign entities.

The Ministry emphasised that this reform aims to establish fair competition, enhance investment confidence, and ensure equal treatment under the law.

Alongside these fiscal reforms, Egypt has witnessed a notable improvement in economic and financial indicators and a decline in external debt over the past three months. The government reports a 73 per cent growth in private investment, reaching its highest level in years.

The country also succeeded in the latest issuance of sovereign sukuk (bonds) valued at $1.5 billion, demonstrating investors’ confidence in Egypt’s fiscal trajectory.

Minister Kouchouk also explained that the ministry is working rapidly to reduce customs clearance times for goods, and that there is full coordination to achieve this.

The reforms have been met with a positive response from the private sector.

The Administrative Capital Company, for instance, paid LE8 billion in taxes from its previous year’s profits, reflecting the growing fiscal responsibility of state-owned enterprises now operating on equal footing with private businesses.