President reviews progress on tax facilitation initiative, fiscal performance

Egypt’s President Abdel Fattah El Sisi has asserted the importance of intensifying efforts to strengthen fiscal discipline through government-led measures that support economic growth and national development. He also emphasised the necessity of maintaining robust allocations for social protection, human capital development, and support programmes targeting priority groups.

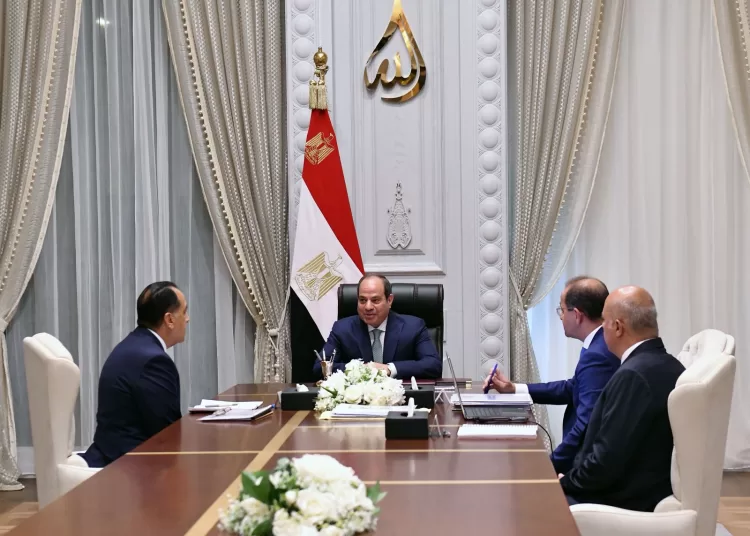

The president’s assertion to this effect came during his meeting yesterday with Prime Minister Dr Moustafa Madbouli and Finance Minister Ahmed Kouchouk, Presidency Spokesman Ambassador Mohamed el-Shennawy said.

President Sisi also directed that all necessary financial and commodity-related precautions be taken to support national economic resilience in light of the current escalation in the region.

During the meeting, Minister Kouchouk presented an update on the first phase of the government’s tax facilitation initiative, which remains in effect until June 19, 2025. He noted that more than 110,000 voluntary tax dispute settlement requests have been submitted to date.

Additionally, the finance minister said in his presentation, over 450,000 amended or newly filed tax returns have been received, reflecting growing taxpayer’s confidence in the initiative. These filings, he said, accounted for an additional LE54.76 billion in declared tax liabilities.

Minister Kouchouk further reported that 52,901 small business owners — whose annual revenues do not exceed LE20 million — have applied for the tax incentives and benefits provided under Law No. 6 of 2025.

Discussions during the meeting also covered the progress of the Finance Ministry’s international debt issuance plan for fiscal year 2024/2025, aligned with the government’s broader strategy to reduce external debt levels, Spokesman Shennawy said, adding that preliminary indicators showed a successful reduction in the external debt stock of budgetary institutions by approximately US$1–2 billion annually.

The minister of finance then reviewed recent developments in the global economic landscape, particularly rising market volatility driven by geopolitical tensions —most notably the ongoing conflict between Iran and Israel — and their implications for key global markets, especially in terms of uncertainty regarding shipping costs and commodity prices.

Regarding actual fiscal performance between July 2024 and May 2025, the finance minister’s presentation highlighted a strong primary budget surplus, a significant narrowing of the overall deficit, and a 36 per cent year-on-year surge in tax revenues, the presidency spokesman said.

This growth, presentation indicated, was driven by enhanced economic activity and a broadened tax base, achieved without introducing new financial burdens on citizens, in addition to the continuation of government efforts to rationalise public spending.

In the course of the meeting, the president was updated on key fiscal targets for 2024/2025, including the projected public debt-to-GDP ratios (both domestic and external), revenue trends, economic growth expectations, wage and compensation frameworks, procurement expenditures, and interest payments.

The current status of public investment projects and Egypt’s ongoing implementation of reforms envisaged under the International Monetary Fund (IMF) programme were then considered, Spokesman Shennawy said, adding that updates were also provided on the government’s negotiations with the IMF to finalise an agreement and secure the disbursement of the fifth programme tranche.

Concluding the meeting, President Sisi called for drawing on global best practices to consolidate fiscal and tax policy stability, improve the investment climate, expand the tax base, and stimulate greater private-sector participation. He also urged sustained efforts to boost production, enhance export capacity, create new job opportunities, and maintain macroeconomic stability in support of national development goals, the presidency spokesman said.