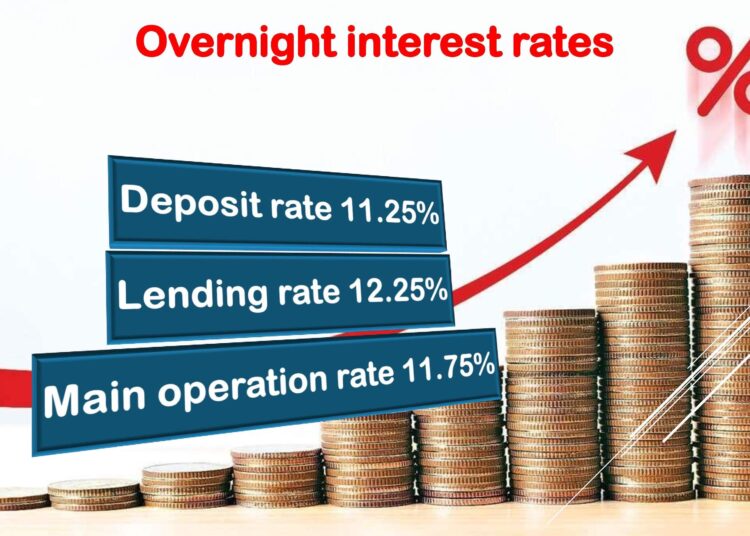

Seeking measures to contain inflation, the Monetary Policy Committee (MPC) of the Central Bank of Egypt (CBE) has raised overnight interest rates by 200 basis points. The MPC increased deposit, lending, and the rate of the main operation by two per cent to 11.25, 12.25 and 11.75 per cent respectively.

It also raised the discount rate by two per cent to 11.75 per cent. Citing slower global economic activity, the MPC said in a statement that trade sanctions imposed on Russia and corresponding supply-chain bottlenecks have elevated global commodity prices, such as international prices for oil and wheat.

Urban consumer inflation increased to 13.1 per cent in April, against 10.5 per cent in March, according to data from the state-run Central Agency for Public Mobilization and Statistics (CAPMAS).

The country’s core inflation rose to 11.9 per cent in April, up from 10.1 per cent in March, according to CBE data.

“Prior to the Russia-Ukrainian war, domestic economic activity continued to expand in 2021 Q4, recording a preliminary year-on-year growth rate of 8.3 per cent, the second-highest real GDP growth rate since 2002 Q3,” it said.

According to the statement, most leading indicators for economic activity have started to gradually normalize, and are expected to continue this trend over the near term, as the strong positive base effect diminishes.

“Going forward, economic activity will continue to expand albeit at a slower-than previously projected pace, partially due to the unfavorable spillovers of international developments emanating from the Russia-Ukrainian war,” it said.

The MPC has said raising rates is necessary to contain inflationary pressures, which is consistent with achieving price stability over the medium term. It forecast the elevated annual headline inflation rate would be “temporarily tolerated” relative to the CBE’s pre-announced target of seven per cent (±2 percentage points) on average in 2022 Q4, before declining thereafter.

The MPC said it would closely monitor all economic developments to maintain price stability. The next MPC’s meeting is scheduled for June 23.

CBE joins NGFS

The CBE has joined the Network for Greening the Financial System (NGFS), which is specialized in the field of the green economy. The network is designed to achieve the United Nations sustainable development goals (SDGs) and the principles of the Paris climate agreement in a bid to enhance the banking sector’s role in managing environmental and climate change risks.

The network, which was launched at the Paris “One Planet Summit” in December 2017, comprises 114 members of supervisory bodies of the financial and banking sectors in the world. The network is seeking the adoption of sustainable and responsible principles in central banks’ investment approaches as well as encouraging climate-related financial disclosure by central banks.

According to the NGFS charter, the group’s membership aims to achieve a diverse representation of institutions in terms of geographic areas as well as between developed and emerging countries.

The NGFS members are committed to actively contributing to the work of the NGFS and dedicating the appropriate resources in their organization to support their participation; raising awareness to the work of the NGFS in their jurisdiction, their geographic area and within the international or regional standard-setting, regulatory, supervisory and central bank bodies they are involved in.

Discussion about this post