CBE’s net international reserves hit 4-year high

Egypt’s net foreign exchange reserves hit a four-year high at $41.057 billion in April, up from $40.361 billion a month earlier, according to data from the Central Bank of Egypt (CBE).

These reserves are essentially assets held by the CBE in foreign currencies, serving as a buffer against external shocks and provide a safety net for the country’s financial system.

In times of economic uncertainty or market turbulence, having a sufficient amount of foreign reserves can help stabilise the exchange rate and prevent sharp depreciation of the domestic currency.

The nation’s foreign reserves comprise a basket of major world currencies, including the US dollar, the euro, the pound sterling, the yen and the yuan. The government has successfully curbed chaotic and excessive imports, narrowing the trade balance deficit.

Therefore, it is no surprise that the nation’s net international reserves have reached their highest level since February 2020, according to CBE data.

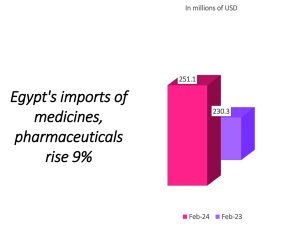

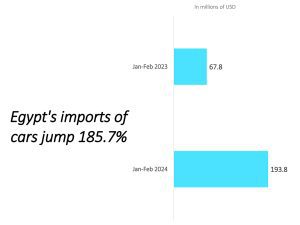

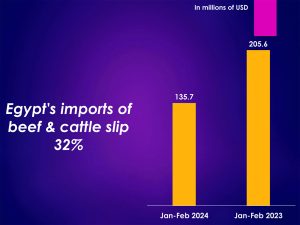

Egypt’s non-oil exports rose by 8.5 per cent to $6.067 billion on the January-February period in 2024, up from $5.591 billion on the same period last year. Imports fell by 6.9 per cent to $12.69 billion on the January-February period, against $13.648 billion during the first two months of 2023.

In the long run, it will be imperative to narrow the gap in the nation’s balance of trade. That will be a key step to secure a surplus in balance of payments in the coming years.

Higher business confidence

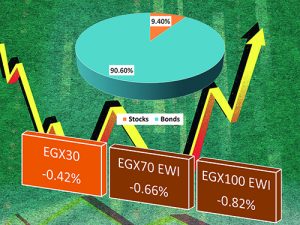

Latest data showed greater confidence among Egypt’s non-oil firms towards the year-ahead outlook for activity. Sentiment was at a six-month high, reflecting hopes of exchange rate stability, lower prices and better material availability, S&P Global said.

S&P Global said improved currency availability, linked to recent policy measures, meanwhile contributed to a notable cooling in the rate of cost inflation to the lowest in over three years. Average prices charged in turn rose only marginally during the month.

The S&P Global Egypt Purchasing Managers Index slightly fell to 47.4 in April, down from 47.6 a month earlier. An index over 50 points indicates growth, while a lower index reflects a contraction.

“Business activity posted a further marked fall at the start of the second quarter. The rate of contraction eased slightly for the second month running, but it nevertheless remained quicker than the average seen over the current sequence of decline stretching back to September 2021,” said an S&P Global report, a copy of which was made available to the Egyptian Mail. The report pointed out that new exports orders were meanwhile broadly unchanged, after having risen in March for the first time in over a year.

“April, meanwhile, saw a renewed decline in non-oil private sector employment, following a slight rise in March. The decrease was the third in the past four months, but only marginal amid varying hiring trends at the sub-sector level,” the report said.

“Business conditions remain challenging across Egypt’s non-private sector. April’s PMI reading of 47.4 is a touchdown on March’s figure and even further below its long-run average, reflecting a renewed fall in employment as well as sustained downturns in output and new orders,” said Phil Smith, Economics Associate Director at S&P Global Market Intelligence.

Discussion about this post