Ahmed Kamel

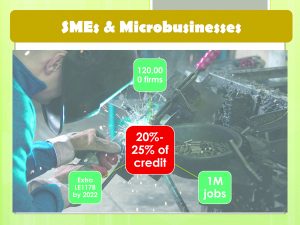

The Central Bank of Egypt (CBE) has obligated local banks to provide small and medium enterprises (SMEs) and microbusinesses with more financing, from 20 per cent to 25 per cent of their credit portfolios.

The move is aimed at boosting credit granted to SMEs and microbusiness in a bid to bolster entrepreneurships and the private sector as a whole. The CBE’s new directive is expected to pump an additional LE117 billion into the SMEs and microbusinesses by the end of December 2022.

A CBE statement said last week that the move would provide adequate financing to more than 120,000 firms across the country, creating and keeping around one million jobs.

Moreover, the local lenders will set up funds companies to invest in SMEs, especially the newly established, thus forming an integrated package of subsidised financing, in addition to contributing capital with small investors to their businesses.

The CBE has noted that the move comes in line with President Abdel Fattah El Sisi’s directives to encourage microbusinesses and SMEs due to their key role in boosting the nation’s economic growth.

“These measures are designed to ensure access to finance, provide the young people with millions of jobs, support the Egyptian industry against foreign products, achieve sustainable economic, financial and monetary stability, and provide an opportunity for the informal economy to integrate into the formal sector,” the CBE statement said.

SMEs and microbusiness have received credit worth LE213 billion between December 2015 and September 2020, CBE data showed.

A minimum10 per cent of banks’ portfolios should be allocated to SMEs and microbusiness, under the new regulations, which will inject roughly LE55 billion into this strategic sector by the end of 2022.

The CBE has launched a number of initiatives since 2015 to urge banks to provide SMEs and microbusinesses with financing solutions at subsidised interest rates.

State budget deficit falls to 4.4%

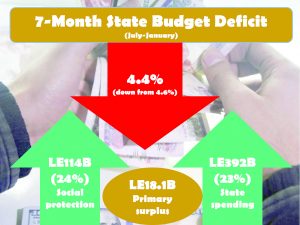

The state budget deficit fell to 4.4 per cent of GDP on the July-January period, compared to 4.6 per cent on the same period the previous year, data from the Ministry of Finance showed.

Primary surplus totalled LE18.1 billion on the July-January period, the first seven months of the nation’s fiscal year 2020/21, which began on July 1. The state budget, which was endorsed in June 2020, was primarily based on a pre-Covid-19 primary surplus forecast at two per cent of GDP.

The state’s expenses to boost economic growth, infrastructure and public services jumped 23 per cent to LE392 billion, Finance Ministry data showed.

The government’s spending on social protection programs increased by 24 per cent to LE114 billion on the July-January period.

The state’s revenues and expenses rose by 16 and 12.4 per cent, respectively, according to Finance Ministry data.

A fiscal stimulus package of 1.9 per cent of GDP has been almost fully committed by the government.

Gold… a strategic asset

in 2021

The scarcity of gold sustains its long-term appeal as a store of wealth and value. Gold is forecast to emerge as a strategic asset in 2021, as the precious metal benefits from diverse sources of demand. The World Gold Council said the Covid-19 pandemic increased uncertainty by compounding existing risks and creating new ones.

“Global central banks have effectively taken interest rates to zero, driving nearly all sovereign debt to negative real yields. With less opportunity for yield across fixed income assets – especially those of shorter duration or higher quality – investors will likely continue to shift exposure to riskier assets. This has pushed many global stock markets to extreme levels on numerous valuation metrics and – importantly – has also served to increase the risk profile of most investment portfolios,” a World Gold Council (WGC) report said.

The WGC said institutional investors have embraced alternatives to traditional investments such as equities and bonds.

“Our analysis shows gold as a clear complement to equities, bonds and broad-based portfolios. A store of wealth and a hedge against systemic risk, currency depreciation and inflation, gold has historically improved portfolios’ risk-adjusted returns, delivered positive returns, and provided liquidity to meet liabilities in times of market stress,” it explained.

The WGC estimates physical gold holdings at around $3.7 trillion. Gold’s traditional role as a safe-haven asset means it comes into its own during times of high risk, the WGC report said.

“But gold’s dual appeal as an investment and a consumer goods means it can generate positive returns in good times too. This dynamic is likely to continue, reflecting ongoing political and economic uncertainty, persistently low interest rates and economic concerns surrounding equity and bond markets,” it noted.

LE60b for housing units

The CBE will provide a total LE60 billion to finance a presidential initiative, ‘Resident for All Egyptians’, to build housing units as part of the government’s social housing plans.

Prime Minister Moustafa Madbouli has called for coordination between the Ministry of Housing and the CBE regarding the provision of the required financing for the presidential initiative.

Madbouli highlighted the importance of continuing coordination among the Social Housing Fund, ministries and state agencies, which own plots of lands in all governorates to build housing units under the initiative.

SCZone to get LE10b

syndicated loan

Four banks have approved a syndicated loan worth $100 million to the Suez Canal Economic Zone (SCZone).

The credit line, granted by Banque du Caire ($30 million), Commercial International Bank ($30 million), Arab African International Bank ($30 million) and Suez Canal Bank ($10 million), is aimed at boosting the authority’s endeavors to invigorate industry and lure investment.

The syndicated loan will total LE10 billion, including $320 million.

National Bank of Egypt will be the lead manager of the loan, which is guaranteed by the Ministry of Finance.

AFC eyes infrastructure

projects in Egypt

Africa Finance Corporation (AFC) is seeking to increase its investments in Egypt in 2021via financing infrastructure projects, especially electricity, natural gas, transportation, logistics and technology.

The Nigerian-based agency plans to invest in up to two projects in Egypt this year.

AFC, the CBE and the Finance Ministry are in talks over Cairo’s joining the agency as a partner with a stake in the capital, Sameh Shenouda, AFC’s Executive Director and Chief Investment Officer, was quoted as saying by the local media.

Discussion about this post