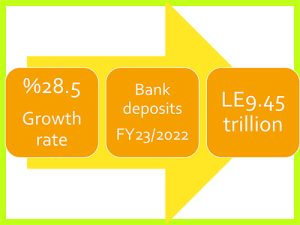

Premiums jumped by 25.6 per cent, year-on-year, to LE61.4 billion in fiscal year 2022/23, up from LE48.9 billion a year earlier, according to data from the Financial Regulatory Authority (FRA).

The number of insurance companies currently operating in Egypt stands at 40. There are 98 brokerage firms, 31 damage assessment companies and nine consulting agencies.

Net investments of Egypt’s insurance companies leaped by 36.2 per cent, year-on-year, to LE208.9 billion in fiscal year 2022/23, up from LE153.4 billion a year earlier, according to FRA data.

The insurance sector posted a surplus worth LE9.8 billion in fiscal year 2022/23, compared to LE8.6 billion a year earlier, according to FRA data.

Insurance versus climate change

There should be insurance programmes to cover losses caused by natural disasters and climate change. To this end, the Egyptian Insurance Federation (IFE) has called for developing new instruments to cover these risks.

Because climate risk is such a complex problem, no single industry or discipline can solve it alone. Businesses, governments and the scientific community are realising that they need to bring all of their capabilities together to address climate risk.

Global natural disasters in 2023 resulted in above-average economic losses totaling $380 billion, according to data from market research firm AON.

There is undoubtedly a sharp increase in the number of disasters that result in more than $1 billion in economic losses globally on a price-inflated basis. This trend can largely be attributed to the increase of exposed assets.

The losses were caused by significant earthquakes and relentless severe convective storm activity in the United States and Europe.

Out of the 66 natural catastrophes that caused a billion dollars or more in damages in 2023, 63 of them were caused by weather.

Yet only 40 percent of weather and climate- related losses were covered by insurance in 2023.

“The single most catastrophic event was the earthquake sequence that hit Turkey and Syria in February. Global losses surpassed $300 billion for the eighth time in a row and were 22 per cent higher than the long-term average,” an AON report, a copy of which was obtained by the Egyptian Mail.

Considering weather-related disasters only, the global total was close to long-term and slightly below the decadal averages.

Insurers across the world covered $118 billion, which was above the 21st century average ($90 billion), as well as the decadal mean ($110 billion).

Extremely high temperature anomalies recorded in many parts of the globe resulted in 2023 being reported as the warmest year on record.

“This became emblematic while a variety of other climate statistics were rewritten amid the wider process of a changing climate. Behaviour of many natural perils continued to be affected not only by the warming trend, but also by the El Niño conditions during the year,” the AON report said.

Many significant events highlighted the need for better disaster preparedness and planning to reduce risks.

There is a tremendous opportunity to close this protection gap, provide real value to clients, and fundamentally strengthen the impact of our industry on how society responds to severe weather and climate risks.

Discussion about this post