Analysis by Ahmed Kamel

Fitch Ratings said last week that Egypt’s economy had outperformed the vast majority of the agency’s sovereigns over the past year. The agency has kept the North African country’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘B+’ with a ‘stable’ outlook.

Earlier this month, Capital Intelligence affirmed the very same rating – ‘B+’ with ‘stable’ outlook – citing the country’s relative economic resilience and adequate level of foreign exchange reserves.

Fitch Ratings said Egypt’s external funding conditions remained broadly favourable.

“Egypt’s net external debt, including non-resident holdings of local debt (at 18 per cent of GDP in FY20) is significantly smaller than the current or forecast ‘B’ category median. Although net external debt will rise in nominal terms, we expect it to remain contained as a share of GDP,” the New York-based agency said in a statement on its website.

Fitch Ratings said government borrowing and a return of non-resident portfolio investors allowed the central bank and commercial lenders to “partly rebuild their net foreign asset positions”.

“Continued economic growth and a modest coronavirus support package have limited the pandemic’s fallout on Egypt’s public finances. We expect a modest and temporary widening in the general government fiscal deficit to 8.5 per cent of GDP in FY21 (including net acquisition of financial assets), from 7 per cent in FY20 and 7.9 per cent in FY19,” it said.

Egypt’s fiscal year begins on July 1.

Debt management

Economists worldwide may disagree about the necessity of an external financial leverage to activate economic growth, but they unanimously agree upon the need to the restructure of the external debt portfolio from time to time.

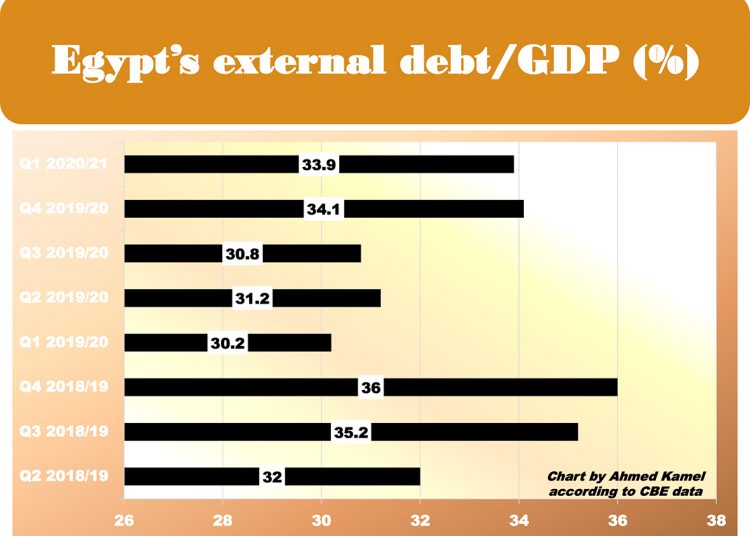

Egypt’s external debt/GDP stood at 33.9 per cent in Q1 of the fiscal year 2020/21, according to the CBE’s monthly bulletin.

Egypt’s external debt service totalled $15.15 billion between January and September 2020, comprising $11.947 billion in installments and $3.207 billion in interest, according to the CBE’s monthly bulletin.

The country’s external debt rose by $12.67 billion, or 11.2 per cent, on the January-September period in 2020 to $125.34 billion, compared to $112.67 billion in December 2019, according to the CBE bulletin.

The components of external debt are the most important issue. The crucial point is to maintain low levels of short-term external debt to boost the economy’s financial stability.

Egypt’s short-term external debt stood at $12.323 billion at the end of September 2020, CBE data showed.

The authorities have cut short-term external debt to total external debt ratio to 9.8 per cent in Q1 of the fiscal year 2020/21, down from 10.1 per cent in the same quarter a year earlier.

The Egyptian government has slashed short-term external debt to international reserves ratio to 25.7 per cent in Q1 2020, down from 41.3 per cent in Q1 2016. Switching to long-term sovereign debt instruments provides the state with sustainable funding resources at a fixed interest.

The nation’s foreign reserves stood at $40.2 billion at the end of February, according to CBE data.

Challenges

Fitch Ratings said the coronavirus pandemic had interrupted Egypt’s progress on debt reduction. It expects the country’s public finances to remain a core weakness of the rating.

“However, we expect debt/GDP to resume a downward path in FY22, and Egypt has significant financing flexibility. We forecast consolidated general government debt/GDP to peak at 90 per cent in FY21, having risen from 88 per cent in FY20 and 84 per cent in FY19, before resuming a downward path,” it said.

Moreover, the rating agency has pinpointed a number of factors that may lead to an upgrade. It said sustained progress on fiscal consolidation, which may lead to a further substantial reduction in the gross general government debt/GDP ratio to a level closer to the ‘B’ median over the medium term.

There’s also significant improvement across structural factors over the medium term, such as governance standards, the business environment and income per capita, to levels closer to ‘B’ and ‘BB’ rated sovereigns.

As for the factors that might lead to a negative rating action, Fitch cited renewed signs of external vulnerability, including persistent downward pressure on international reserves and the emergence of financing strains, failure to resume a path of narrowing the fiscal deficit and prolonged economic repercussions of the pandemic.

Discussion about this post