Egypt’s consumer financing leaped by 58.8 per cent, year-on-year, to LE47.27 billion in 2023, up from LE29.76 billion a year earlier, according to data from the Financial Regulatory Authority (FRA).

The number of consumer financing beneficiaries jumped by 21.2 per cent, year-on-year, to 3.38 million in 2023, up from 2.79 million in 2022.

Cars and vehicles accounted for 36.2 per cent, or LE17.11 billion, of consumer financing in 2023. Electrical appliances and electronics were in the second place, snatching 30.74 per cent, or LE14.53 billion, according to FRA data.

Home finishing and equipment accounted for 5.56 per cent, or LE2.62 billion, pf consumer finance in 2023. Clothes and shoes accounted for 4.62 per cent, or LE2.18 billion. Furniture and home furnishings snatched 3.23 per cent to LE1.52 billion in 2023, according to FRA data.

By definition, a consumer financing firm provides loans to customers without receiving deposits. It is part of the non-banking finance instruments.

The government is tipped to boost non-bank finance, which includes leasing, factoring and mortgage finance schemes, to provide the private and public sectors with more funding options. The non-bank funding instruments include leasing, factoring and mortgage finance schemes.

The non-bank credit solutions offer low-cost funding compared to bank loans. Higher interest rates have driven consumers to buy goods directly from the retailers away from banks.

The overnight deposit and lending rates currently stand at 27.25 and 28.25 per cent respectively, data from the Central Bank of Egypt (CBE) showed.

The International Monetary Fund urges countries worldwide to boost the non-bank finance to provide the private and public sectors with more funding instruments.

Banks post net profits worth LE283.38b

Egyptian banks posted net profits worth LE283.38 billion in 2023, up from LE130.844 billion a year earlier, according to CBE data.

Bank capital, reserves and provisions rose to LE410.87 billion, LE476.47 billion and LE346.92 billion in 2023.

Bank assets stood at LE14.2 trillion at the end of December 2023, according to CBE data.

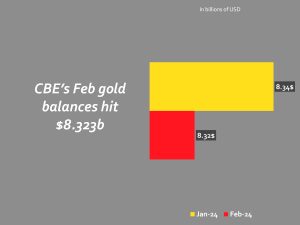

Gold ETFs shed $2.9b in February

Global gold ETFs collectively saw another outflow in February, extending their losing streak to nine months; North America led outflows, while Asia was the only region that captured inflows, the World Gold Council (WGC) said a report.

Outflows from global physically backed gold ETFs continued for the ninth consecutive month, shedding $2.9 billion in February. Combined with a 0.3 per cent gold price fall, total assets under management (AUM) fell to $206 billion (-1.8 per cent month-on-month), the lowest since last September.

“In turn, collective holdings of global gold ETFs lost 49 tonnes to 3,126 tonnes, 20 per cent lower than their month-end record of 3,915 tonnes in October 2020. Nonetheless, the two recent rounds of sustained outflows had little negative impact on the gold price performance, which was supported by resilient consumer demand and blistering central bank purchases,” said a WGC report, a copy of which was made available to the Egyptian Mail.

North American funds lost the most while outflows from Europe narrowed. In contrast, Asia has now seen net inflows for 12 consecutive months and other regions have seen only limited loss.

Discussion about this post