The Central Bank of Egypt (CBE) withdrew, in an open market tender last week, liquidity worth LE1.249 trillion from 29 local banks at 27.75 per cent interest rate. The move is part of CBE’s role in managing banks’ excess liquidity for enhancing the impact of monetary policy.

The CBE is seeking best international practices well manage the banking sector’s excess liquidity in a bid to improve effectiveness of its monetary policy decisions.

The CBE’s Monetary Policy Committee (MPC) kept interest rates unchanged on July 18. The MPC left overnight deposit and lending rates steady at 27.25 and 28.25 per cent, respectively, according to CBE data.

The MPC has reiterated that the path of future policy rates remains a function of inflation expectations rather than prevailing rates and will not hesitate to utilize all tools at its disposal to ensure that the policy stance is set at sufficiently restrictive levels that allow for a sustained decline in underlying inflation, and safeguard price stability over the medium term.

Urban inflation eased to 27.5 per cent in June, down from 28.1 per cent a month earlier, according to data from the state-run Central Agency for Public Mobilization and Statistics (CAPMAS).

Core inflation, which takes out fruit, vegetables and energy from calculating consumer inflation, fell to 26.6 per cent in June, down from 27.1 per cent in May, according to CBE data.

Domestic liquidity rises to LE10.62 trillion in June

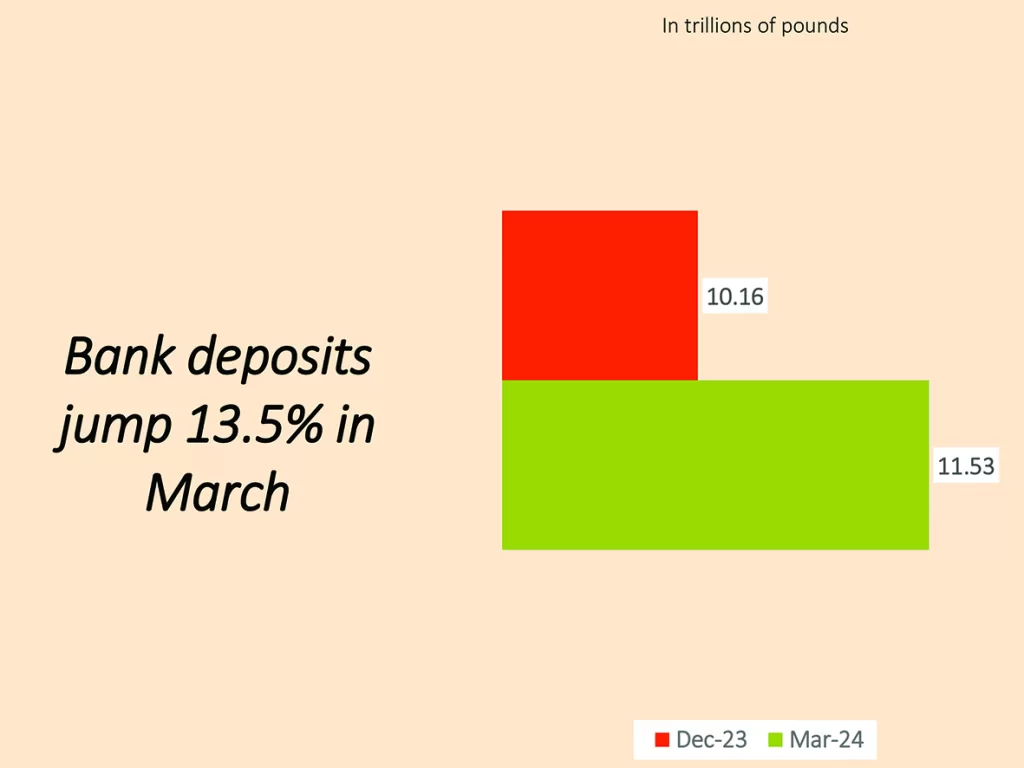

Domestic liquidity rose to LE10.62 trillion in June 2024, up from LE8.87 trillion in December 2023, according to CBE data.

Domestic liquidity refers to the amount of money circulating within a country’s economy. It includes cash, bank deposits, and other forms of liquid assets that can be easily converted into cash.

Egypt’s money supply (M2) edged up to LE2.7 trillion in June, up from LE2.37 trillion in December 2023. Currency in circulation outside the central bank rose to LE1.226 trillion in June, up from LE1.06 trillion in December 2023, CBE data showed.

M2 includes coins and currency in circulation (M1) in addition to bank deposits. From an economic perspective, higher levels of money supply indicate higher inflation rates. Demand deposits in local currency increased to LE1.47 trillion in June, against LE1.3 trillion in December 2023. Quasi-money stood at LE7.9 trillion in June, compared to LE6.5 trillion in December 2023, according to CBE data.

7-month RTGS payments hit LE155.8 trillion

Egypt’s seven-month interbank payments in the local currency via real time gross settlement (RTGS) system totaled LE155.8 trillion between January and July 2024 through 1.416 million transactions, according to CBE data.

RTGS systems are typically overseen by the CBE to ensure stability and compliance with regulations.

RTGS payments totaled LE16.89 trillion and LE25.28 trillion in June and July through 175,500 and 222,800 transactions, respectively, according to CBE data.

RTGS payments hit LE21.66 trillion and LE21.55 trillion in April and May through 192,200 and 206,209 transactions, respectively, according to CBE data.

The system processes transactions individually and settles them immediately, ensuring real-time and irrevocable payments. RTGS systems are crucial for large-value and time-sensitive transactions, such as interbank transfers, securities trading, and high-value corporate payments.

Discussion about this post