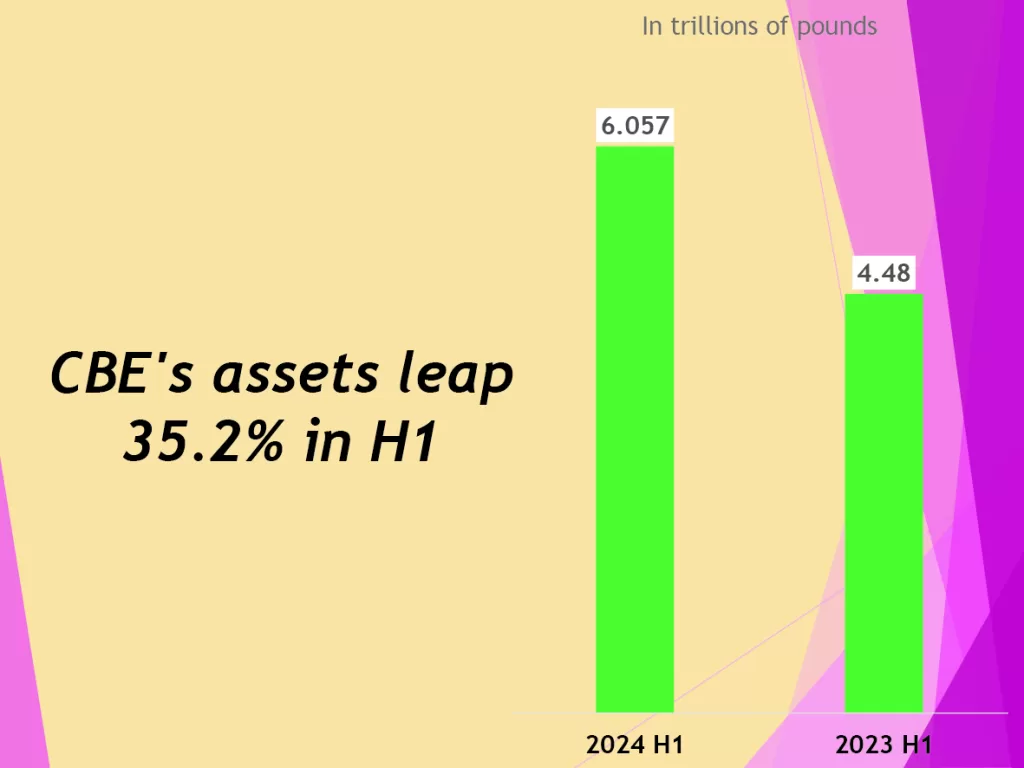

The aggregate financial position of Egyptian banks rose to LE18.73 trillion in May 2024, compared to LE14.2 trillion in December 2023, according to data from the Central Bank of Egypt (CBE).

The banking sector’s holdings of treasury bills increased to LE5.228 trillion in May 2024, up from LE5.18 trillion in December 2023. The local banks’ capital rose to LE450.21 billion in May 2024, against LE410.87 billion in December 2023, according to CBE data.

The banking sector’s reserves increased to LE805.99 billion in May 2024, compared to LE476.47 billion in December 2023. Provisions rose to LE470.57 billion in May 2024, against LE346.9 billion in December 2023, according to CBE data.

Household sector gets credit worth LE1.01 trillion

Bank credit to the household sector rose to LE1.01 trillion in May 2024, up from LE933.32 billion in December 2023. Household credit accounted for 14.6 per cent of bank loans in Egypt, according to CBE data.

Bank loans to the household sector in the Egyptian pound rose to LE987.42 billion in May 2024, up from LE918.27 billion in December 2023, according to CBE data.

The household sector snatched loans worth LE24.12 billion in foreign currencies in May, up from LE15.05 billion in December 2023, according to CBE data.

Bank deposits rise to LE11.83 trillion in May

Bank deposits rose to LE11.83 trillion in May 2024, up from LE10.16 trillion in December 2023, according to CBE data.

Government and non-government deposits hit LE2.62 trillion and LE9.21 trillion in May 2024. Government deposits comprised savings in the Egyptian pounds worth LE2.11 trillion and LE511.32 billion in foreign currencies, according to CBE data.

Non-government deposits consisted of LE6.74 trillion in the Egyptian pounds and LE2.47 trillion in foreign currencies, according to CBE data.

ETFs adds $2.1b in August

Global physically backed gold exchange-traded funds (ETFs) added $2.1 billion in August, extending their inflow streak to four months, according to the World Gold Council (WGC).

All regions reported positive flows: Western funds once again contributed the lion’s share. Gold ‘spreading’ positions in options, a normally quieter corner of the gold market, are at a multi-year high, suggesting that investors are either hedging or speculating on both a rate-cutting cycle and the outcome of the US election.

“The 3.6 per cent rise in the gold price, paired with further inflows, lifted global assets under management (AUM) by 4.5 per cent to another month-end peak of $257 billion. Collective holdings continued to rebound, increasing by 29 tonnes to reach 3,182 tonnes by the end of the month,” said a WGC report, a copy of which was obtained by the Egyptian Mail.

Global gold ETFs’ year-to-date losses further narrowed to $1 billion thanks to non-stop inflows between May and August. According to WGC data, the decline in holdings so far in 2024 has also been trimmed down to 44 tonnes. Meanwhile, the total AUM jumped by 20 per cent during the first eight months of 2024.

“Global gold trading volumes slightly fell, reaching $241 billion/day in August, 3.2 per cent lower month-on-month. Average trading volumes over-the-counter (OTC) rose further by 5.9 per cent month-on-month to $158 billion/day,” the WGC report added.

Discussion about this post