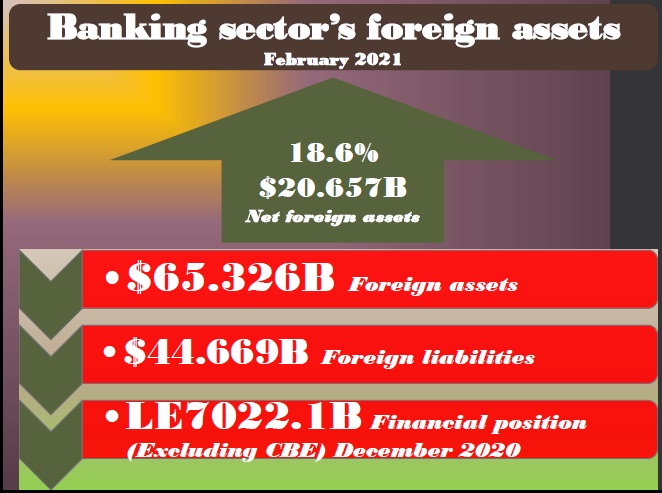

The banking sector’s net foreign assets jumped 18.6 per cent, or $3.25 billion, to $20.657 billion in February, up from $17.854 billion a month earlier, data from the Central Bank of Egypt (CBE) showed.

The foreign assets of banks totalled $65.326 billion in February, up from $61.686 in January, according to CBE data. The CBE’s foreign assets rose to $39.294 billion at the end of February, compared to $39.143 billion the previous month.

The banking sector’s foreign liabilities increased by $387 million to $44.669 billion in February, up from $44.281 billion in January, CBE data showed.

The CBE’s foreign liabilities rose to $25.739 billion, up from $25.734 billion the previous month.

The non-government deposits in foreign currencies fell by $ 2.7 million to $ 41.188 billion in February, down from 41.191 in January.

The demand deposits in foreign currencies rose by $476.94 million to $ 9.330 billion in February, up from $8.853 billion a month earlier, according to CBE data. The fixed deposits in foreign currencies slipped $ 479.64 million to $ 31.858 billion in February, down from $ 32.338 billion the previous month.

Meanwhile, the banking sector’s net domestic assets rose by 5.3 per cent, or LE232.8 billion, on the July-December period of the fiscal year 2020/21, according to CBE data.

The aggregate financial position of banks, excluding the CBE, jumped 9.6 per cent on the July-December period of the fiscal year 2020/21 to LE7022.1 billion at end of December 2020, CBE data showed.

Banks face asset-quality deterioration

Fitch Ratings has said Egyptian banks face asset-quality deterioration and continued pressure on profitability through 2021 amid the economic fallout of the pandemic.

The agency has noted that capitalisation remains a credit weakness and foreign-currency liquidity is still vulnerable to external shocks.

“However, the sector could benefit from growth and revenue opportunities, with Egypt’s lockdowns less stringent than those in many jurisdictions, and consumer consumption and public investment more resilient,” Fitch Ratings said on its website.

“We expect continued pressure on operating profitability due to lower interest rates and higher loan impairment charges as borrower support measures end. We do not expect this to lead to capital erosion, but capitalization remains a credit weakness given banks’ high exposure to the sovereign and large individual obligors,” it said, adding that regulatory capital ratios are inflated by the zero risk-weighting on local-currency sovereign debt.

The banking sector average Stage 3 loans ratio was stable at 3.4 per cent at end-3Q 2020, supported by the CBE’s significant interest rate cuts to boost lending, a six-month deferral of loan repayments and flexibility on how banks classify loans, Fitch Ratings said.

“However, we believe these measures have delayed rather than prevented asset-quality deterioration,” it argued.

Gov’t to resume IPOs by Q3

Minister of Public Business Sector Hisham Tawfik said last week that the state would resume a long-awaited programme for initial public offerings (IPOs) by the third quarter this year.

The minister has said a government committee, entrusted with the IPOs program, is discussing with investment banks the best possible timing for the resumption of IPOs. He noted that there are 11 opportunities for partnership with the private sector.

The minister added that the amendment of the Public Business Sector Law restored the government’s control over subsidiaries and boosted governance within state-owned companies.

The IPOs are deemed to be a magical wand to pump fresh cash into the economy. In 2018, the government unveiled a plan to free float stakes in 14 state-owned companies for the first time and increase the floated stakes in nine others. The 23 companies were selected from the oil and petrochemical, logistic, financial services, real estate and manufacturing sectors.

The programme has been put on hold due to a number of reasons, basically because of inappropriate market sentiment for the past couple of years.

New margin trading regulations by 2022

The Financial Regulatory Authority will give brokerages a grace for readjustment with new regulations for margin trading by the beginning of 2022.

The new regulations set a cap on margins for each stock as 25 per cent of floated shares or 15 per cent of market capitalisation, whichever is higher. Moreover, a cap was set on margin trading per investor and their related parties two per cent of free floated stocks or one per cent of the stock’s market capitalisation, whichever is higher.

The new regulations are aimed at the boosting of margin trading on the Egyptian Exchange by widening the base of dealers via decreasing the concentration risk of margin buying in a limited number of investors. The objective is to lower risk of margin trading on the market as a whole.

Islam Azzam, FRA Deputy Chairman, told the local media last week that margin trading topped LE6.5 billion.

Azzam forecast the new regulations would lift margin trading to LE75 billion, while lowering risks of concentration.

Margin trading is defined as the use of borrowed funds to buy securities. It is a market mechanism that increases volumes and investment returns.

Public debt maturity rises to 3.2 years

The government has increased public debt maturity to 3.2 years in June 2020, up from 1.3 years in June 2013, Finance Minister Mohamed Maeet has said.

Minister Maeet said the debt maturity would reach 3.6-3.8 years by the end of June.

The state budget has posted a primary surplus worth LE25 billion on the July-March period of the fiscal year 2020/21, which will end on June 30, Maait said.

The minister said tax revenues rose by 13.5 per cent, year-on-year, compared to the same period a year earlier. He explained that despite the Covid-19 pandemic, the state’s revenues increased by14.6 per cent on an annual basis, while expenses rose by 11.2 per cent, year-on-year.

Government investments rose by 45 per cent to LE163.7 billion on the July-March period of the 2020/21 fiscal year. The government investments financed by the state treasury jumped 29 per cent to LE118 billion on the July-March period, compared to the same period a year earlier.

Discussion about this post