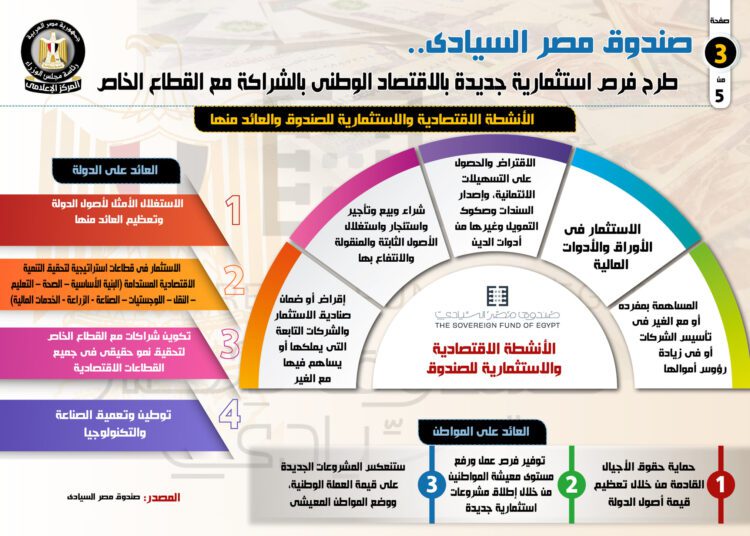

Cairo- Egyptian cabinet’s media centre Wednesday published an infographic report highlighting the role of Sovereign Fund of Egypt in offering new investment opportunities in partnership with the private sector. The Fund, which was established in 2018 to attract private investment in Egypt’s under-used assets and contribute to Egypt’s economic growth, is independently managed by senior executives from the finance industry.

The minister of planning and economic development is chairman of the fund’s board of directors, of whom five are independent experts, plus representatives of the ministries of planning, finance and investment, the report said. The fund operates in accordance with international best practice, with a clear and flexible investment focus allowing it to form a wide range of partnerships. The fund was issued with capital of LE200 billion ($12.8 billion) and an initial working capital of LE5 billion ($ 320.5 million), of which LE3 billion has been paid and the remainder payable in fiscal year 2021-2022. The report said four subsidiary funds have been launched with a licensed capital of LE30 billion each. These include Infrastructure and Utilities Sub-Fund, Healthcare and Pharmaceuticals, Tourism, Real Estate and Antiquities Sub-Fund, Financial Services and F-intech Sub-Fund. The fund was aimed to achieve sustainable financial returns in the long term through a balanced and diversified portfolio designed to strikes a balance between risks and returns. The fund has taken many investment steps, as several protocols and memoranda of understanding have been signed, in addition to partnerships with various stakeholders from the private sector, the cabinet media centre report said. At international level, a memorandum of understanding was signed with Actis, a global emerging markets investment firm, in January 2020 to promote investments in energy and infrastructure. At regional level, a joint strategic platform was established with the UAE in November 2019 with a value of $20 billion to invest in a number of sectors and assets. At local level, two memoranda of understanding were signed for joint investment in energy and infrastructure projects with investors. In March 2021, the fund subscribed to EFG Hermes’ Education Fund and Partners with GEMS Egypt to launch two schools West of Cairo. The schools will be constructed on SFE-owned land in line with its mandate to create value out of previously unutilised assets. These investments made by SFE in the education sector serve to underscore the state’s strategic priorities, in line with political leadership’s vision to achieve the over arching sustainable development principles and goals outlined in Egypt’s Vision 2030. In December 2020, the fund signed a cooperation protocol with the Internal Trade Development Authority, and inked a protocol to establish the National Railway Egyptian Industries Company (NERIC) in November in partnership with the private sector to localise the railway industry in Egypt. The report referred to the signing of a memorandum of understanding with the National Service Projects Organisation to develop its subsidiaries in February 2020, as well as the signing of two framework agreements in November 2019 with the Ministry of the Public Business Sector and the National Investment Bank to maximise the benefit from their assets. The cabinet’s report also reviewed SFE co-operation with global sovereign funds, as the fund became an official member of the International Forum of Sovereign Wealth Funds. Egypt’s sovereign fund has been ranked 41st among the 95 sovereign wealth funds globally in terms of asset size. The SFE has total assets worth $11.959 billion, accounting for 0.14 per cent of the total assets managed by all sovereign wealth funds globally. According to the Sovereign Wealth Fund Institute (SWFI) data, the total global assets of the 95 sovereign funds are worth $8,3 trillion. The fund also participated in various direct investment forums around the world to introduce available investment opportunities in Egypt. It also actively participated in the sovereign funds forums, including the African sovereign wealth funds

Discussion about this post